The Looming Shortage of Submarine Power Cables and Its Impact on the Offshore Wind Market

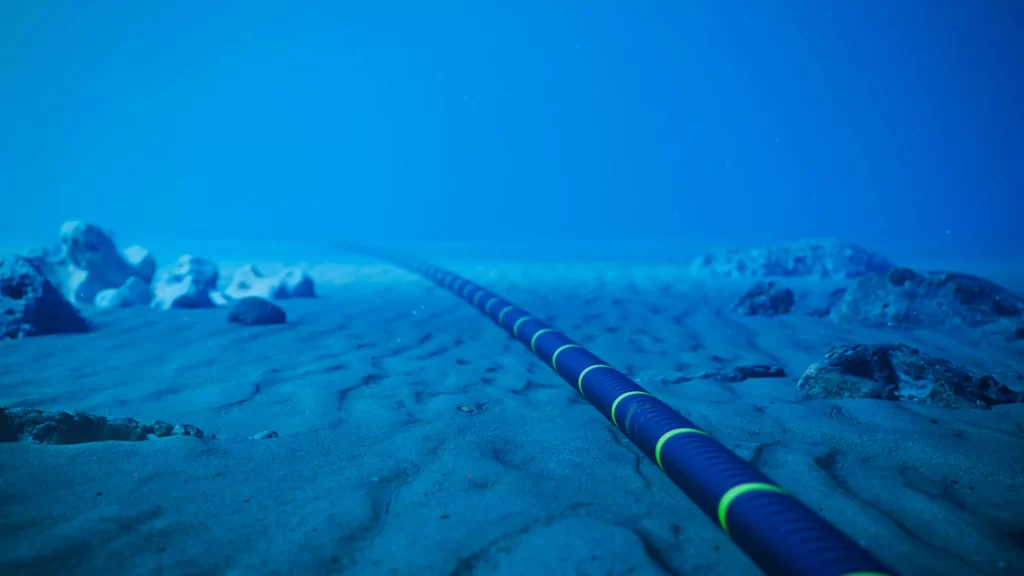

The rapid growth of the offshore wind industry has exposed a critical bottleneck: the shortage of submarine power cables. This issue not only complicates the installation and maintenance of wind farms but also poses a substantial threat to the industry’s overall development.

#### The Burgeoning Demand

Offshore wind infrastructure requires an extensive network of high-voltage direct current (HVDC) submarine cables to transmit electricity from turbines to onshore substations and then to the grid. With the global ambition to transition to renewable energy sources and reach Net Zero targets, the demand for these cables has surged. Forecasts indicate that the demand for offshore wind cables could double by 2030, reaching a staggering 95,000 kilometers[3].

#### Manufacturing Capacity Constraints

The market is faced with severe capacity constraints in submarine power cable manufacturing. Only a handful of companies, including NKT from Denmark, Prysmian from Italy, and Nexans from France, dominate approximately 75% of the HVDC market. However, these companies are fully booked until the late 2020s, leading to a looming shortage for countries outside of China, which has invested heavily in bolstering its HVDC sector[4].

#### Technological Challenges

The need for larger, longer, and higher-voltage cables to support bigger and more distant offshore wind farms compounds the problem. Upgrades to manufacturing equipment and bespoke cable production exacerbate supply chain challenges. This requires a significant technological leapfrogging, which is not only expensive but also time-consuming. According to Rameeza Duggal, a senior cables analyst at 4C Offshore, the 10-year forecast for offshore wind cable demand has doubled between 2018 and 2023[3].

#### Installation and Maintenance Complexity

The installation of these cables is technically challenging and highly specialized. There are only a limited number of vessels capable of laying, repairing, and maintaining these cables, with fewer than 60 such ships operating worldwide, the majority of which are aging[4]. This limited fleet hinders the progress of offshore wind farm developments, adding to project delays and costs.

#### Cable Failure and Insurer Concerns

Cable failure is another significant concern. According to a report by IMCA, nine out of ten insurance claims on offshore wind subsea cables are due to installation damage. This not only incurs substantial repair costs but also leads to extended downtime,